Real-Time Processing

What is Real-Time Processing

The speed of money matters more than ever in today's digital economy. Traditional payment methods—such as ACH, checks, or wire transfers—often introduce unnecessary delays, inefficiencies, and reconciliation challenges. Businesses need a faster, smarter way to move money.

Real-Time Processing through RTP® (Real-Time Payments) and The FedNow® Service is redefining how organizations manage payments. These networks allow funds to move instantly, 24/7/365, across participating banks and credit unions nationwide.

With TodayPayments.com, your business can tap into true real-time processing with multiple banking relationships, flexible merchant IDs, and full integration into your existing workflows. No paper forms, no bank visits—just instant payment power at your fingertips.

What Is Real-Time Processing in Payments?

Real-Time Processing refers to the ability to send and receive funds with immediate confirmation and settlement, without delays or batch windows. Through RTP® and FedNow®, businesses can:

- Transfer funds in real time between bank accounts

- Confirm payments instantly with no float or settlement delay

- Operate 24/7, including weekends and holidays

This improves cash flow, customer experience, and financial accuracy—giving your business more control over every transaction.

Alias-Based Transactions for Simplicity and Security

Rather than using full bank account details, our platform supports alias-based payment routing. You can:

- Use cell phone numbers as payer or payee aliases

- Route funds using email addresses linked to different deposit banks

- Assign multiple MIDs to manage payments under different profiles or business segments

This increases security while allowing you to manage real-time processing across multiple recipients and accounts.

Support for All Payment Methods and Business Models

Our platform handles real-time processing across a wide range of industries and payment types:

- Retail and POS transactions

- MOTO (Mail Order / Telephone Order) billing

- Invoicing via text, email, and mobile links

- Subscriptions, service payments, and B2B transfers

No matter how you collect or send payments, we ensure they’re completed instantly and securely.

QuickBooks® Integration and Automated Reconciliation

Real-Time Processing is only complete when it ties into your financial reporting. We integrate directly with QuickBooks® Online (QBO) to:

- Automatically sync real-time transactions

- Eliminate manual reconciliation errors

- Provide real-time treasury views of every payment

Finance teams can view, match, and manage payments the moment they happen.

ISO 20022 Messaging and Hosted Payment Pages

For structured requests and professional presentation, we offer:

- Support for ISO 20022-compliant Request for Payment (RfP) messaging

- Branded Hosted Payment Pages embedded in invoices, emails, or customer portals

- Real-time settlement and notification once payments are completed

These tools are ideal for businesses that want to request payments with full control, visibility, and speed.

Benefits for Payees (Recipients of Payments):

- Immediate Access to Funds:

- Payments are received and available for use instantly, improving cash flow and liquidity.

- Reduces the need for short-term borrowing or credit to manage cash flow.

- Enhanced Security:

- Advanced security measures protect against fraud and unauthorized transactions.

- Masked Payments feature ensures sensitive financial information is kept confidential.

- Operational Efficiency:

- Automated payment processing and reconciliation reduce manual intervention and errors.

- Streamlines accounting processes, saving time and resources.

- Improved Cash Flow Management:

- Real-time visibility into incoming payments allows for better planning and financial management.

- Enables more accurate forecasting and budgeting.

- Customer Satisfaction:

- Faster processing times lead to higher customer satisfaction and loyalty.

- Real-time payment confirmation provides assurance to customers.

- Reduced Costs:

- Lower transaction fees compared to traditional payment methods.

- Decreases administrative costs associated with handling checks or delayed payments.

- Innovation and Flexibility:

- Supports various payment models such as on-demand pay, just-in-time payments, and recurring payments.

- Enables adoption of new financial technologies and services.

Benefits for Billers (Issuers of Payment Requests):

- Timely Payments:

- Real-time processing ensures payments are made and received promptly, reducing delays.

- Helps in meeting financial obligations and maintaining good relationships with suppliers and partners.

- Improved Collections:

- Request for Payment (RfP) feature allows billers to send payment requests to customers, facilitating prompt payments.

- Reduces outstanding receivables and improves cash flow.

- Increased Efficiency:

- Automates billing and payment processes, reducing the need for manual follow-ups and paperwork.

- Enhances overall operational efficiency and reduces errors.

- Better Customer Experience:

- Offers customers the convenience of immediate payment options, enhancing their payment experience.

- Real-time updates and confirmations improve transparency and trust.

- Cost Savings:

- Lower processing fees compared to traditional methods like credit cards or checks.

- Reduces costs associated with late payments and collections.

- Enhanced Financial Control:

- Real-time tracking and reporting provide better control over finances.

- Enables proactive management of cash flow and working capital.

- Competitive Advantage:

- Offering real-time payment options can differentiate a business from its competitors.

- Attracts customers who prefer or require instant payment capabilities.

Implementation Tips:

- Choose a Reliable Provider: Select a provider like SecureQBPlugin.com that integrates seamlessly with your accounting systems and supports both RTP and FedNow.

- Ensure Security: Implement robust security measures to protect transaction data and comply with regulatory requirements.

- Automate Processes: Leverage automation to streamline payment and reconciliation processes, reducing manual work and errors.

- Train Staff: Provide training to employees on the benefits and use of real-time payment systems to maximize efficiency.

- Monitor Performance: Regularly review and monitor the performance of the real-time payment system to ensure it meets business needs and identifies areas for improvement.

By leveraging real-time processing through RTP and FedNow, payees and billers can significantly enhance their financial operations, reduce costs, and provide a better experience for their customers and partners.

Features & Benefits

FedNow instant payments has benefits for all parties involved in

Financial Transactions.

Benefits to your company include:

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

Money Transfer: Current limit of $1,000,000 ~ FedNow, $10,000,000 ~ RTP.

It's Final: All RTP and Instant Payments are Final & Irrevocable.

It's Fast: 24/7/365 access to funds anytime vs.

several days for paper checks or ACH transfers to process.

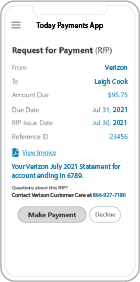

Request for Payments ( RfP ™): Mobile & Online Real-Time Bill Payments.

Software Integration: Integrate your A/R & A/P Management

or Enterprise software with us.

Message Detail: Full 145 characters available

using ISO 20022 messaging XML format.

Online Down Payments: Don't use inconvenient

and expensive Wires & Cashier's Checks.

Online Real-Time Reporting: Configured

Dashboard with Virtual Terminal login.

Reduced calls / emails in the "Purchasing Chain": All

parties to a instant payment transaction receive immediately

text & email messaging.

The

FedNow and RTP Systems enables Participants to initiate credit transfers,

receive final and irrevocable settlement for credit transfers,

and make available to Receivers funds associated with such

credit transfers in real-time, twenty-four (24) hours a day,

seven (7) days a week, fifty-two (52) weeks a year. All instant payments are "Credit

Push" instead of "Debit Pull."

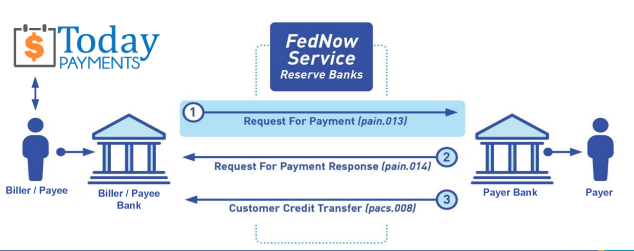

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting files using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Real-Time Processing system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Real-time Payments processing